Submit your tax exemption details

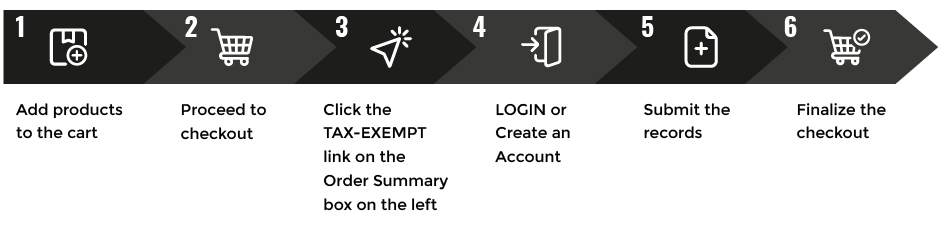

Simple Steps to Submit Your Tax Exemption Certificate

Before you submit, make sure your tax exemption certificate is valid and includes:

- Seller’s name and mailing address

- Purchaser’s name, mailing address

(and check all statements that apply) - Property description, invoice number, and date of purchase

- For blanket certificates - check all statements that apply

- Purchaser's signature – make sure to sign and date the form!

- An expiry date for the State your purchase is being shipped to

How to Submit

If you're a tax-exempt customer, you may submit your tax exemption certificate using the steps below:

SUBMIT YOUR TAX EXEMPTION DETAILS

Please note: If your document is expired or is determined to be invalid later date,

we may collect sales tax and reach out to you offline to address any issue.

What is a Tax Exemption Certificate?

According to the Sales Tax Institute, "Sellers are required to charge sales tax on all transactions subject to tax except when a jurisdiction's rules allow for the sale to be made tax-exempt."

Exemption certificates for sales tax allow you to make tax-free purchases that would generally be subject to sales tax.

Once you have your certificate submit it to the seller, and then you can make purchases without being charged sales tax.

Who Qualifies?

The requirements to qualify for sales tax exemption vary by State and may depend on the purpose of your organization and or tied to Section 501 of the Internal Revenue Code.

If you have questions about your eligibility for tax exemption, you can find more information on the U.S. Chamber of Commerce, U.S. Department of State, and IRS websites.

How to Apply for a Tax Exemption Certificate?

If you do not have a tax exemption certificate but feel you qualify, information about applying for tax-exempt status is available online.

If you have any questions about submitting your tax exemption certificate to Acudor Access Panels, call us at 888-622-8367 and we are happy to assist!